Finding the right financial solution for purchasing a vehicle can be daunting, especially when dealing with credit challenges. Many prospective buyers feel overwhelmed by the complex terms and high rates typically associated with car loans.

At Moneybarn, we offer fair, transparent financial services tailored to your needs, whether you want to finance a car, motorbike, or van. Our flexible options and comprehensive support system are designed to help you secure a loan that fits your financial situation and credit background.

As you read on, dive deeper into our offerings and services. We’re here to guide you through every step, ensuring you make the best lifestyle and budget decisions.

Exploring MoneyMoneybarn’s Offerings

Moneybarn stands out in the vehicle finance market with its diverse options for different needs and budgets. Whether you’re your first car, upgrading to a new motorbike, or investing in a van for business purposes, Moneybarn provides tailored financing solutions.

Our products are designed to accommodate various financial situations, mainly catering to those with less-than-perfect credit scores.

Comprehensive Vehicle Finance Solutions

At Moneybarn, we understand that purchasing a vehicle is a significant decision. That’s why we offer a variety of finance solutions to make this process as smooth and straightforward as possible. From competitive APR rates to flexible repayment terms, we aim to help you find a financing plan that aligns with your financial goals and lifestyle needs.

Car Finance Options

Our car finance plans are flexible and accessible, making getting behind the wheel of your desired car easier. We accommodate applicants with various credit histories and clearly outline repayment expectations and interest rates.

Whether you’re looking for a compact city car or a more spacious family vehicle, our finance options are crafted to meet your circumstances and budget.

Motorbike Finance Options

For those passionate about two wheels, Moneybarn offers motorbike finance that understands the thrill and necessity of owning a motorbike. Our options cater to all types of riders, from commuters to adventure enthusiasts.

With straightforward terms and the ability to manage payments in a way that suits you, we make motorbike ownership accessible to more people, regardless of their credit history.

Van Finance Options

Understanding the crucial role vans play in both personal and commercial use, Moneybarn provides bespoke van finance options. Whether its delivery services or transporting goods, our van finance solutions help you expand your business or support your lifestyle needs without the financial burden of upfront costs.

We offer competitive rates and terms designed to help you manage your finances effectively while owning the van that best suits your needs.

Also Read: Benefits of Ausschütter: Get Amazing Returns Of Investments

Why Moneybarn? Advantages of Choosing Us

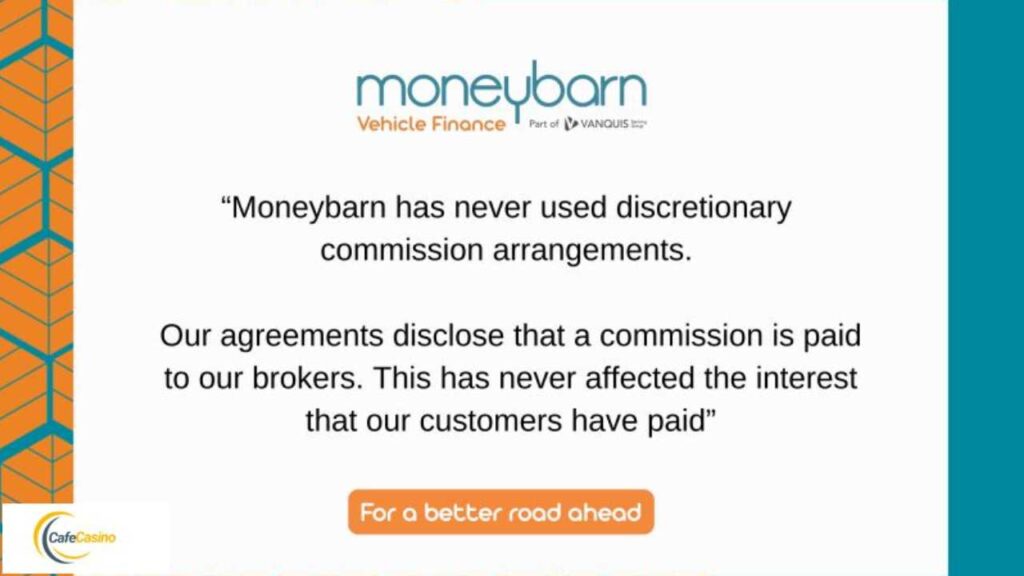

Choosing Moneybarn for your vehicle financing needs means trusting a company dedicated to fairness and transparency. We are committed to providing a range of finance options that suit everyone, no matter their financial background or credit history. Our focus is on making vehicle financing accessible and stress-free, helping you to make confident financial decisions.

Catering to a Diverse Clientele

At Moneybarn, we pride ourselves on serving a wide variety of customers. We understand that everyone’s situation is unique, and we strive to offer solutions that reflect this diversity. Whether you are self-employed, have faced financial difficulties, or are just starting to build your credit, we have options tailored to your needs.

Specialized Services for Bad Credit

We believe that a less-than-perfect credit score shouldn’t prevent you from owning a vehicle. That’s why we specialize in car finance for individuals with bad credit.

Our team works closely with you to understand your financial situation, offering loans with realistic terms and manageable payments. We aim to help you improve your credit score while enjoying the benefits of vehicle ownership.

Recognition and Awards

MoneyMoneybarn’sitment to excellence has not gone unnoticed. We have been recognized within the industry for our ethical practices and customer-centric approach. Winning awards such as the “Sub “rime Lender of the Year“ and “receiving high commendations at various national credit awards underscores our dedication to providing high-quality services.

These accolades reflect our continuous effort to be the best in the field, reassuring our customers that they are making the right choice with Moneybarn.

Also Read: Piperens: Amazing Health & Culinary Benefits

How Moneybarn Works: A Guide to Our Process?

Understanding how to navigate our financing options is straightforward. We’ve designed our application process to be as simple and transparent as possible, ensuring you know exactly what to expect every step of the way.

From checking your eligibility to gathering the necessary documents, we guide you through each phase, making your journey towards owning a vehicle smooth and hassle-free.

Application Process Simplified

Our application process is designed to be quick and easy. Getting financial assistance for your vehicle should not be a burden. Our online tools and dedicated team guide you through every step, ensuring you understand the terms and how the loans can work best for you.

Eligibility Criteria

To apply for finance with Moneybarn, you must meet some essential criteria. These include being between 20 and 75, holding a valid UK driving license, and having a minimum monthly income of £1,000 after tax. We aim to offer financial solutions to many individuals, including those who might not qualify with other lenders due to their credit history.

Required Documentation for Loan Approval

When you apply for vehicle finance with us, you must provide some essential documents. These include two consecutive months of payslips, proof of address, and your current driving license. These documents help us better understand your financial situation and tailor our offer to fit your needs precisely.

Navigating MoneyMoneybarn’somer Service

We pride ourselves on our customer service, which is designed to provide you with all the support you need, whether you’re applying for a new loan or managing an existing one. Accessible and helpful, our customer service team is here to ensure your experience is positive every step of the way.

Accessing Your Account

Managing your account should be easy and convenient. That’s why we’ve streamlined the process, allowing you to log in securely online to view your loan details, make payments, and get support whenever needed.

Moneybarn Login Details

To access your account online, simply visit our website and click on the ‘Logi’ section. You’ll then see your registered email and password. If you’re logging in for the first time or have forgotten your details, our online help is available to guide you through the process smoothly.

Contacting Support

Our customer support team is just a call or click away. We understand that questions and issues can arise and are committed to providing prompt and comprehensive responses.

Moneybarn Contact Number and Online Help

Call our dedicated contact number or use our online help system if you need to contact us. Our team is equipped to handle all inquiries, from simple questions about your account to more complex issues regarding your finance terms. We ensure that every customer receives the attention and support they need.

Also Read: Savings Money with 7OFF7ROO: Your Ultimate Guide to Deliveroo Discounts

(FAQs)

How long does Moneybarn take to pay out?

Moneybarn typically processes payouts within a few business days after your loan application is approved and all necessary paperwork is completed. The exact time can vary depending on individual circumstances, but we aim to ensure you can purchase your vehicle as soon as possible.

Who owns Moneybarn?

Moneybarn is part of Provident Financial Group, a leading provider of financial services in the subprime market. Established many years ago, Provident Financial Group offers consumers a range of credit products across the UK.

Can I change my car with Moneybarn?

Yes, you can change your car with Moneybarn. This process involves settling your existing finance agreement and applying for a new one for your new vehicle. Our team is on hand to guide you through the options and ensure a smooth transition.

Can I give my car back to Moneybarn?

If you cannot continue with your finance agreement, Moneybarn offers solutions such as voluntary termination. This option allows you to return the vehicle under certain conditions, typically once you’ve half the amount due. Please get in touch with us to discuss your specific circumstances.

Has Moneybarn gone bust?

No, Moneybarn has not gone bust. We continue to operate as usual, providing vehicle finance solutions to our customers. As a reputable and financially stable company, we are committed to supporting our customers’ needs.

Conclusion

Choosing Moneybarn for your vehicle financing needs comes with numerous advantages. We offer flexible financing options that cater to a wide range of credit histories, making it easier for you to obtain a car, motorbike, or van regardless of your financial past. Our process is straightforward and designed to be as stress-free as possible, with a supportive customer service team ready to assist you every step of the way.

We understand the importance of reliable transportation and strive to provide solutions that help you achieve your personal or business mobility goals. Whether trying to improve your credit score or find a finance plan that fits your budget, Moneybarn is here to help.

Explore our finance options today and start your journey towards owning the perfect vehicle. Our team is eager to guide you through the process and help you make the best decision for your circumstances.

Also Read: Luv.trise: Revolutionizing User Experience in Tech